CF Industries’ Q2 2025 Earnings: What to Expect

Valued at a market cap of $15.7 billion, CF Industries Holdings, Inc. (CF) is a leading global producer of hydrogen and nitrogen products, primarily ammonia, granular urea, UAN, and ammonium nitrate, used as fertilizer, in emissions control, and various industrial applications. Headquartered in Northbrook, Illinois, and founded in 1946, CF operates nine manufacturing complexes across the U.S., Canada, and the U.K., and owns the world’s largest ammonia production network

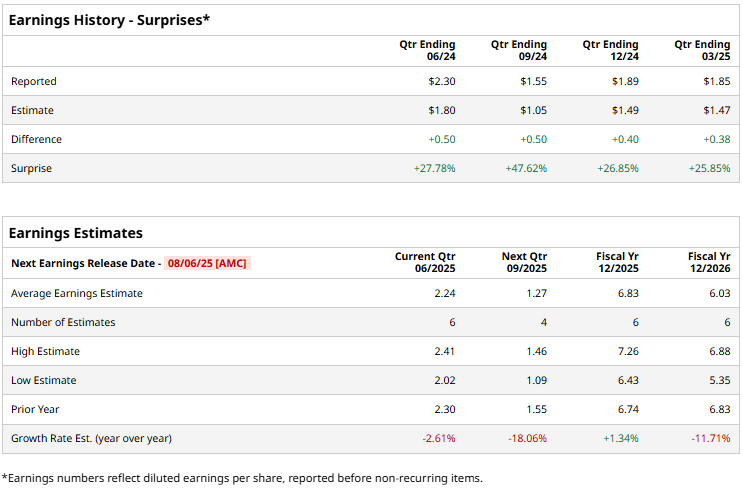

CF is all geared to announce its Q2 earnings for 2025 after the market closes on Wednesday, Aug. 6. Ahead of this event, analysts expect this agricultural inputs company to report a profit of $2.24 per share, down 2.6% from $2.30 per share in the year-ago quarter. The company has exceeded Wall Street's earnings estimates in each of the last four quarters.

For fiscal 2025, analysts expect CF to report a profit of $6.83 per share, up 1.3% from $6.74 in fiscal 2024.

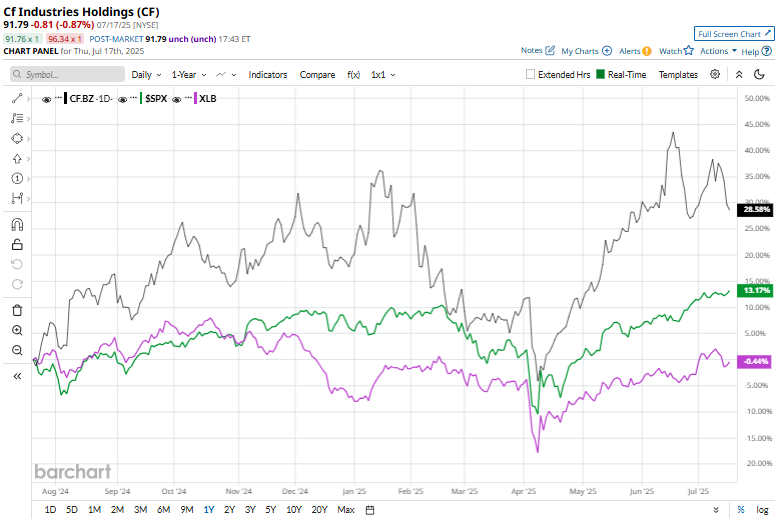

Shares of CF have climbed 26% over the past year, significantly outpacing the S&P 500 Index's ($SPX) 12.7% gain and the Materials Select Sector SPDR Fund’s (XLB) 5.8% fall over the same time period.

CF reported strong Q1 results on May 7, and its shares rose marginally in the following trading session. Revenue climbed 13.1% year-over-year to $1.7 billion, beating consensus estimates by 9.2%. Net income per share surged 79.6% to $1.85, exceeding forecasts by 25.9%, thanks to a substantial 660 basis-point expansion in gross profit margin.

Wall Street analysts are skeptical about CF’s stock, with a "Hold" rating overall. Among 16 analysts covering the stock, three recommend "Strong Buy," 12 indicate “Hold,” and one suggests a “Strong Sell” rating.

While CF currently trades above its mean price target for CF of $88.67, its Street-high target of $105 indicates a 14.2% potential upside from the current levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.