Can Meta Platforms Stock Hit $935 in 2025?

/Facebook%20on%20a%20phone%20by%20geralt%20via%20Pixabay.jpg)

Meta Platforms (META), the social media giant formerly known as Facebook, has seen incredible profit growth in recent years as the company’s high-margin business model continues to spit off excess cash flow the company has used to reinvest in growth. An added focus on efficiency in recent years has driven Meta’s earnings considerably higher. In CEO Mark Zuckerberg’s words, 2023 was the “year of efficiency” – but this mantra has extended through the years since.

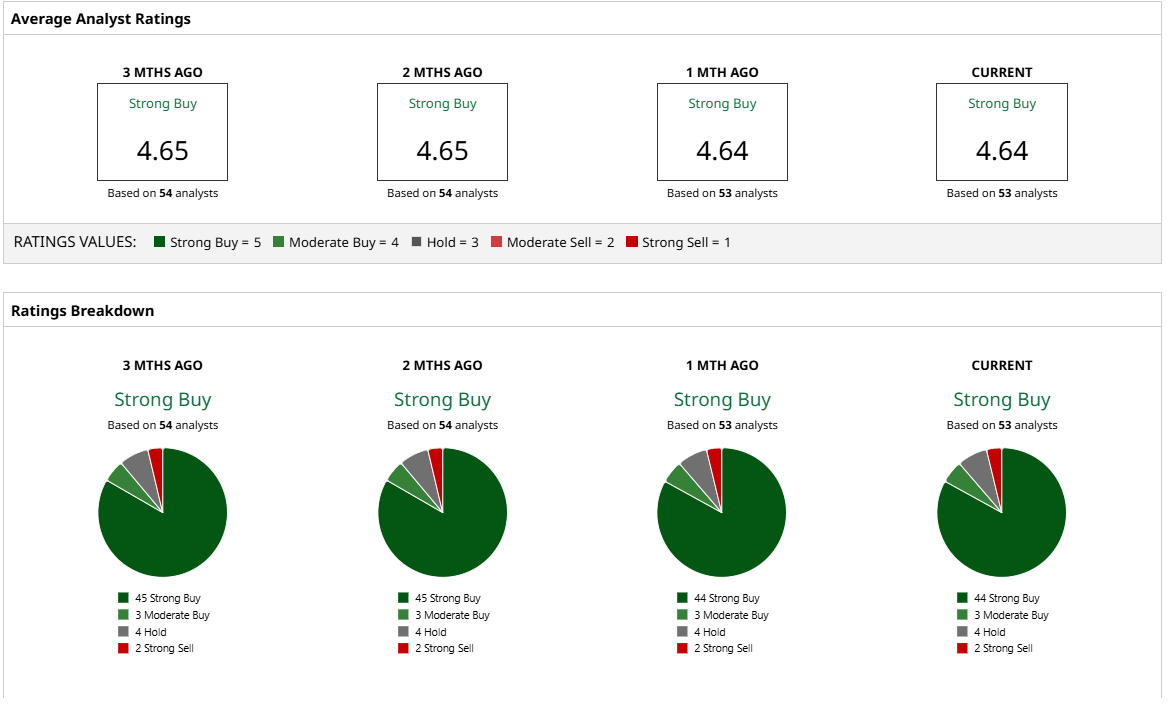

With this in mind, it should be no surprise to investors that Wall Street remains bullish on shares with a consensus “Strong Buy” rating.

Tigress Financial analyst Ivan Feinseth has the Street-high price target of $935, implying roughly 34% upside potential from current prices.

Let’s dive in to see whether such a price target is achievable and what would lead to such price appreciation.

Of Course It’s Achievable

Meta has been a remarkable performer in recent years, posting incredible gains of roughly 40% over the past 12 months, in line with what Tigress asserts is possible over the next 12.

Much of the bull case for Meta comes from the company’s operating metrics, which continue to drive its valuation premium. I’ve been in the camp that such a premium has been warranted for some times, and the numbers really do talk.

Looking at the chart above, Meta’s forward price-earnings ratio of around 27.2 times is more than twice the sector median. However, the company’s market-beating returns on both equity and assets, as well as its very meaty profit margin of nearly 38%, stand as key reasons why this stock is trading at a premium. Simply put, market participants continue to believe that Meta has significant likely upside from here as it continues to grow much faster than the overall market.

What Do Other Analysts Think?

Tigress Financial is far from the only analyst on the Street rating META stock favorably.

With a high price target of $935 per share and a low target of $466, there is some variance in terms of what analysts predict for Meta Platforms. However, for a company like Meta that has seen such impressive price appreciation recently, it is possible that some of the lower price targets were put in place during the recent April slump. Meta and its peers fell in early April following the announcement of “Liberation Day” tariffs as investors became worried about an impending recession. With those fears easing, U.S. tech stocks have resumed their races higher.

The reality is that Meta continues to garner a “Strong Buy” rating from analysts overall, suggesting this stock is certainly at least a hold at current levels. I’d expect the mean price target to increase from its current level around $698 per share, roughly in line with its current price. This is just a stock that tends to move much quicker than analysts can update their models.

With this in mind, my view is that the Street-high price target makes sense. For long-term investors looking for exposure to a winner, Meta still looks attractive here.

On the date of publication, Chris MacDonald did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.