How Is L3Harris Technologies’ Stock Performance Compared to Other Aerospace & Defense Stocks?

/L3Harris%20Technologies%20Inc%20NY%20office%20building-by%20JHVEPhoto%20via%20iStock.jpg)

With a market cap of $45.8 billion, L3Harris Technologies, Inc. (LHX) is a leading global aerospace and defense contractor, formed in 2019 through the merger of L3 Technologies and Harris Corporation. Headquartered in Melbourne, Florida, the company provides mission-critical systems across air, land, sea, space, and cyber domains.

Companies valued at $10 billion or more are generally classified as “large-cap” stocks, and L3Harris Technologies fits this criterion perfectly. Its market leadership stems from its diversified defense portfolio, strong operational execution, and strategic positioning in high-demand sectors like communications, space, and missile propulsion.

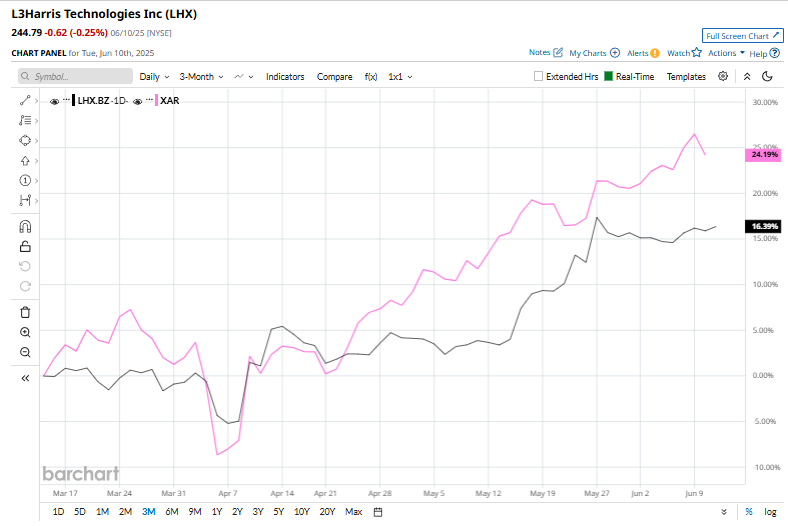

However, LHX shares are currently down 7.9% from their 52-week high of $265.74 reached on Nov. 11. Shares of the defense giant have surged 12.4% over the past three months, surpassing the SPDR S&P Aerospace & Defense ETF’s (XAR) 24.9% return over the same time frame.

LHX stock is up 16.4% on a YTD basis, outperforming XAR’s 18.8% decline. However, shares of L3Harris have climbed 10.6% over the past 52 weeks, lagging behind XAR’s 38.8% rise in the same time frame.

Nevertheless, LHX has been trading above its 50-day moving average since early April and over its 200-day moving average since mid-May, indicating an uptrend.

Following the release of its Q1 earnings on April 24, L3Harris Technologies saw a marginal dip in its share price. Revenue came in at $5.1 billion, falling short of analyst expectations by 1.9%, largely due to weaker sales in Integrated Mission Systems and a drop in Space & Airborne Systems revenue. But, its adjusted EPS rose 7.1% year-over-year to $2.41, exceeding forecasts.

Due to the recent divestiture of its Commercial Aviation Solutions business, the company has revised its full-year 2025 guidance downward, now expecting revenue to be between $21.4 billion and $21.7 billion, with adjusted EPS projected to be in the $10.30 to $10.50 range.

In the dynamic defense and aerospace landscape, LHX has underperformed its key rival, GE Aerospace (GE). GE has skyrocketed 48.6% over the past year and 45.1% in 2025.

The stock has a consensus rating of “Strong Buy” from 20 analysts' coverage, and its mean price target of $262.24 implies an upswing potential of 7.1% from the current market prices.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.